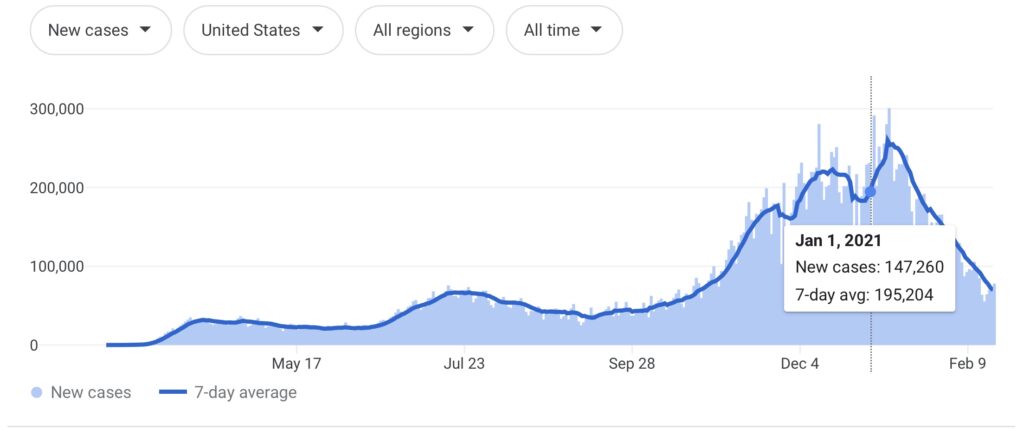

Could a change in how the HHS reimburses doctors for COVID expenses have caused the drop in cases beginning in mid January?

An article from February 5th, 2021 states:

“New coronavirus case counts are now steadily dropping across the United States, as the worst of the latest surge in the pandemic seems to be subsiding.

Nationally, that daily average peaked on Jan. 8, with nearly 260,000 new cases, The New York Times reported. But by Feb. 3, that figure was 136,442, a 47 percent drop from that peak.”

Claims as to why cases are dropping ranges from suggesting that people are voluntarily changing their behavior (social distancing, not gathering, wearing masks…) due to reports of the virus surging this winter, to reduced travel, to winter weather closing some testing sites (likely mostly in Texas or Oklahoma), or the idea that the vaccine is working to prevent transmission (despite the fact that there is no evidence from phase 3 clinical trials to support this conclusion).

It might be that some PCR testing centers have started to follow recent World Health Organization recommendations on reducing the cycle threshold from 40 to around 32 or less, so that there is a reduced chance of false positives… but we don’t yet know if the CDC has mirrored this WHO guidance for the US.

A more likely scenario for the US is that our case numbers are being impacted by a new Department of Health and Human Services (HHS) definition for what kinds of expenses “attributable to coronavirus” can be financially reimbursed by the federal government.

Let me explain further for clarity.

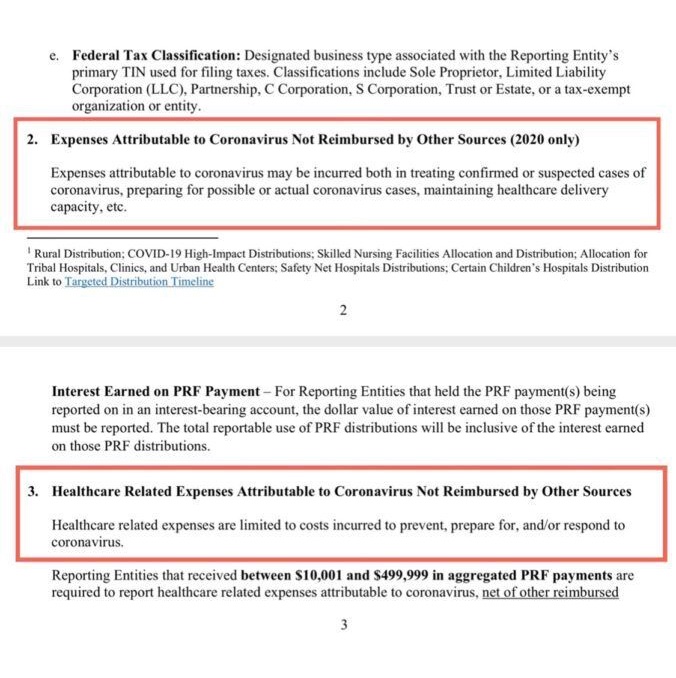

On January 15th, 2021, the HHS issued new guidance to health care providers regarding the Provider Relief Fund and which COVID-related expenses are eligible for reimbursement.

From The National Law Review:

“HHS has deleted previous guidance stating that “expenses attributable to coronavirus may be incurred both in treating confirmed or suspected cases of coronavirus, preparing for possible or actual coronavirus cases, maintaining healthcare delivery capacity,”

and has now indicated that eligible healthcare related expenses “are limited to costs incurred to prevent, prepare for, and/or respond to coronavirus.”

This appears to be a potentially significant change intended to only permit incremental COVID-19 expenses to be allocated to Provider Relief Funds.”

IN OTHER WORDS:

Doctors are no longer going to be financially reimbursed by the federal government for treating or preparing for suspected or confirmed cases of COVID…

As of January 2021, doctors will be reimbursed for costs primarily associated with prevention – getting more people to take the vaccine.

Note, in the updated text, that it says nothing about reimbursing COVID cases of any kind, just prevention of, preparation for, and response to “coronavirus”.

Essentially, the HHS has been paying doctors for every potential or confirmed COVID case they account for in their practice, but as of January, this is no longer happening.

Unfortunately, while this will most certainly affect the actions of health care providers and shift their focus as they move forward, the public is not being made aware of these changes.